A Insightful Perspective on Foreign institutional Investors (FIIs) in India

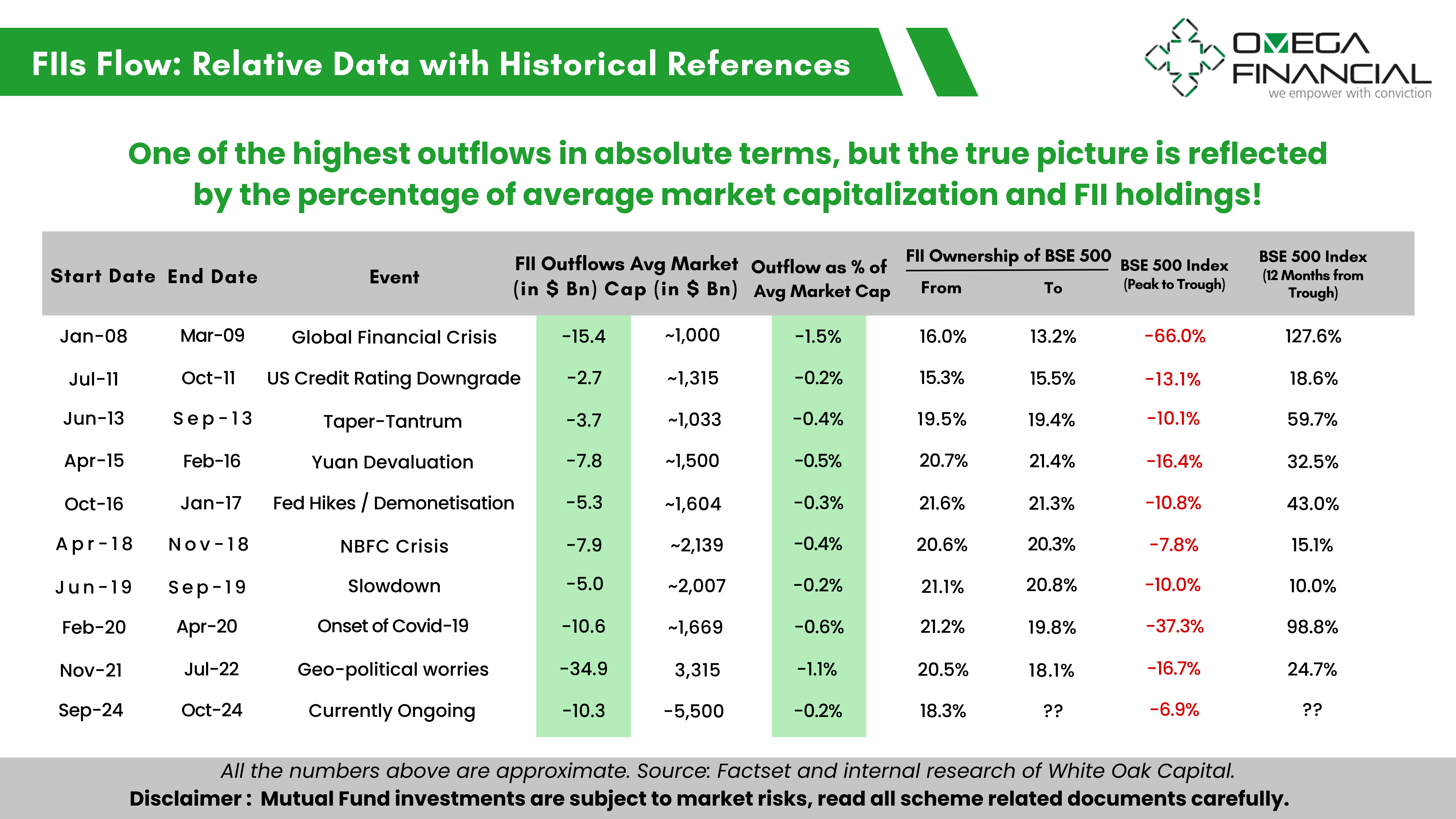

A crucial context to evaluate the impact of FII outflows.

Key points:

1. Indian Market Capitalization: ~$5.3-5.5 trillion (5300 Billion – 5500 Billion)

2. FII holding: 18% ($950-1,000 billion)

3. Outflow perspective: $10 billion represents only ~1% of FII holdings

This math puts things into proportion, suggesting that:

1. FIIs still maintain a significant stake in India.

2. Outflows, while noteworthy, are relatively small compared to their total holdings.

3. Indian markets can absorb these outflows without significant disruption.

Additional factors to consider:

1. Domestic institutional investors (DIIs) have been net buyers, offsetting FII outflows.

2. India’s economic fundamentals, growth prospects, and reforms continue to attract foreign investment.

3. Global economic conditions, interest rates, and risk appetite influence FII flows.

- Disciplined asset allocation

- Consistent investing

- Patience

Remember :

1. Avoid emotional decisions based on short-term market fluctuations

2. Focus on fundamental analysis and economic indicators

3. Rebalance your portfolio periodically

Stay invested, stay calm, and let time do the magic!

Stay invested, stay calm, and let time do the magic!

Investments are subject to market risks, read all scheme-related documents carefully