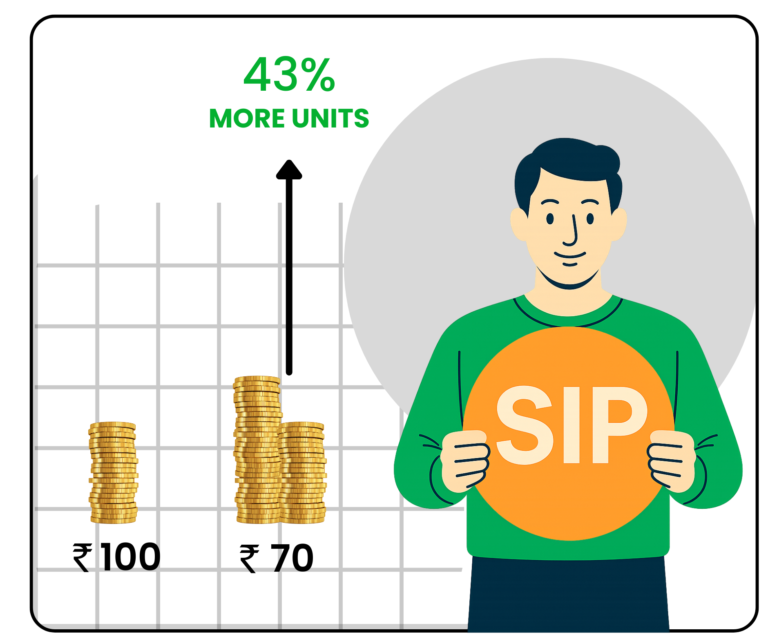

SIP wins both ways: when NAV rises, wealth grows; when NAV falls, units grow.

Most people celebrate rising NAVs. But there’s another kind of bull market investors overlook. One where you accumulate more units when NAVs fall. For a long-term SIP investor, falling NAVs aren’t a problem. They’re an opportunity to build wealth quietly in the background. If your NAV drops from R100 to {70, your SIP buys 43% more units.

These additional units don’t feel exciting at the moment. But when NAVS recover, they compound into serious wealth.

Over time, your portfolio is driven less by price movements and more by the number of units you own.

Investing isn’t just about celebrating portfolio highs. It’s about recognising that some of your best wealth-building years may look like drawdowns. You don’t just want higher prices.

You want more ownership. And that comes only when you invest during difficult times.

Volatility isn’t the enemy — impatience is.

Some investors expect equity to deliver FD-like smoothness with higher returns.

That expectation is fundamentally flawed.

Equity returns are earned because investors are willing to withstand volatility.

Without that discomfort, there would be no Historical SIP data shows that in small-cap funds over the last 25 years: –

3-year SIPs were negative 18% of the time

5-year SIPs: 7% chance of loss

7-year SIPs: almost no chance of loss

Volatility might hurt in the short run, but it disappears with time and discipline.

Don’t chase the 12% myth — real returns are rarely linear.

The notion that equity yields 12% returns has become the norm. But that number is a statistical average. In reality, no investor earns 12% consistently.

What you actually earn depends on when you invest and how you behave.

Take two people investing in the same fund.

One starts at a market peak, the other after a crash. Their return journeys are wildly different.

The second

The first may see years of no return. The second may see double-digit compounding immediately. That’s the risk of relying on averages.

Past returns fade — philosophy stays. Choose the latter.

“The worst way to choose a mutual fund is by chasing last year’s top performer. A fund that did well in the past 3 years often doesn’t repeat that performance. Because what matters isn’t the number, but the process”

Disclaimer: The information provided in this infographic is for educational purposes only and should not be considered as financial advice. We recommend consulting a certified financial professional before making any major financial decisions. Omega Financial is not liable for any decisions made based on this material.

Investment in the equity market and securities is subject to market risk; read all the scheme-related documents carefully.

Source: ET Money