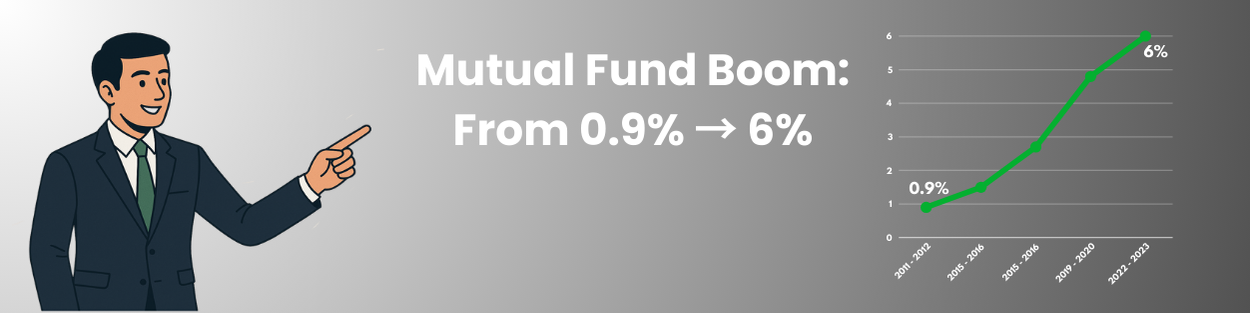

In the last decade, India’s investment landscape has undergone a silent but powerful revolution. What was once a market dominated by traditional savings instruments like bank deposits, gold, and real estate is now seeing a decisive shift toward financial assets—particularly mutual funds. A clear reflection of this change lies in a striking statistic: the share of mutual funds in household financial savings has jumped from just 0.9% in FY 2011-12 to nearly 6% in FY 2022-23.

This six-fold growth is not just a number; it represents a structural change in how Indian households are thinking about wealth creation, financial security, and future planning.

Why Has This Boom Happened?

Several factors have converged to make mutual funds a mainstream choice for investors:

1. Rising Financial Awareness

Through initiatives by SEBI, AMFI, mutual fund houses, and distributors, financial literacy has improved significantly. Campaigns like “Mutual Funds Sahi Hai” have demystified investing for the average Indian, encouraging retail investors to take their first step into equities through SIPs.

2. Shift from Physical to Financial Assets

For decades, gold and real estate dominated Indian household balance sheets. However, post-2010, rising property prices, regulatory bottlenecks, and lower rental yields reduced the appeal of real estate. Gold, while still cherished culturally, no longer delivers consistent inflation-beating returns. Mutual funds, with their transparency, liquidity, and compounding potential, have emerged as a strong alternative.

3. Strong Market Performance

Equity markets in India have delivered robust returns over the last decade, with the Nifty 50 moving from ~5,000 levels in 2011 to nearly 20,000+ by 2023. Investors who started SIPs in 2013–14 witnessed firsthand the power of compounding, further strengthening trust in mutual funds.

4. Systematic Investment Plans (SIPs)

The SIP revolution has been a game changer. With as little as ₹500 a month, households can participate in India’s growth story. Today, SIP inflows cross ₹20,000 crore monthly, showing how small, disciplined contributions are collectively powering the mutual fund industry.

5. Technology & Access

The rise of fintech apps, online platforms, and e-KYC has made investing seamless. What once required paperwork and physical signatures can now be done with a few clicks on a mobile phone. This ease of access has particularly resonated with younger investors.

Implications of the 6% Share

While 6% may still sound small compared to the dominance of fixed deposits, it signals a structural transformation.

- Broader Participation – Mutual funds are no longer just an urban phenomenon. Tier II and Tier III cities are contributing significantly to SIP inflows, showing the democratization of financial markets.

- Diversification of Household Portfolios – As investors move from physical assets to mutual funds, households are building more balanced portfolios that can handle inflation, volatility, and long-term needs like retirement.

- Boost to Indian Capital Markets – Domestic investors, through mutual funds, are emerging as a counterbalance to Foreign Institutional Investors (FIIs). This creates market stability and reduces dependence on external flows.

Challenges That Remain

Despite the boom, challenges remain:

- Penetration is still low compared to developed markets like the U.S., where mutual funds form nearly 45–50% of household financial assets.

- Awareness gaps persist in rural and semi-urban areas.

- Investor behavior during market volatility (e.g., panic redemptions) shows that financial literacy must continue to deepen.

The Road Ahead

The next decade looks even more promising. India’s demographics—young population, rising incomes, digital adoption, and aspirational middle class—are all aligned to propel mutual funds further. SEBI and AMFI’s push for inclusion of women investors and small-ticket SIPs will expand participation. Meanwhile, innovations like passive funds, target-date funds, and thematic strategies will cater to evolving investor preferences.

If mutual funds can grow from 0.9% to 6% of household savings in a decade, it is not far-fetched to imagine this figure doubling again in the next 7–10 years. For households, this means a more empowered financial future. For distributors, it is a golden opportunity to add value, build trust, and become true partners in wealth creation.

Conclusion

The surge of mutual funds in Indian household savings is more than just an investment trend—it is a cultural shift in how we view money. From being cautious savers, Indians are learning to become confident investors.

As a mutual fund distributor, your role is crucial in this journey—bridging the gap between aspiration and execution, between uncertainty and financial confidence. The boom is here, and it’s just the beginning.

Disclaimer: The information provided in this infographic is for educational purposes only and should not be considered as financial advice. We recommend consulting a certified financial professional before making any major financial decisions. Omega Financial is not liable for any decisions made based on this material.

Investment in the equity market and securities is subject to market risk; read all the scheme-related documents carefully.