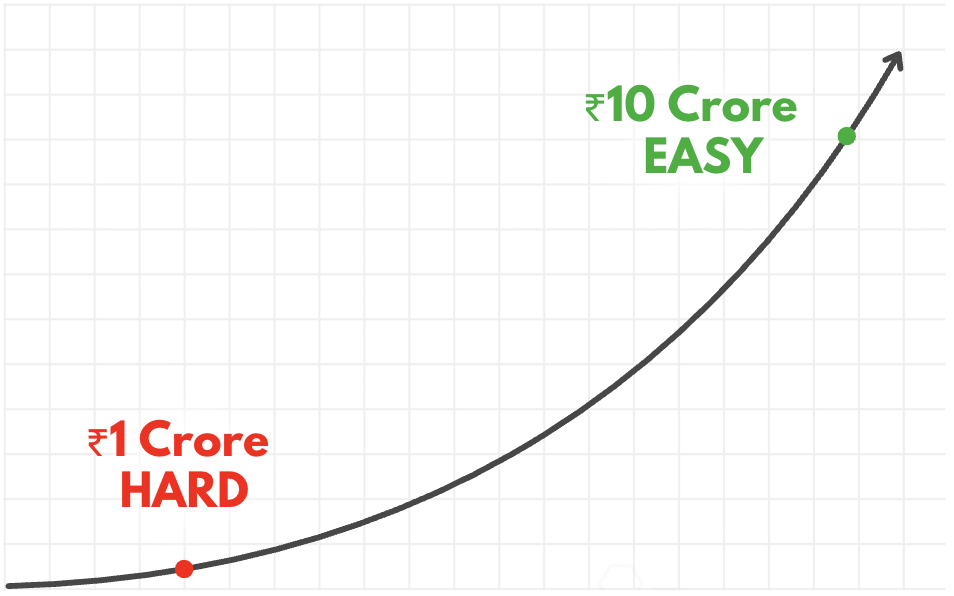

The journey from ₹1 crore to ₹10 crore doesn’t get harder. It gets faster.

Here’s the math and mindset shift that explains why :

Let’s start with some surprising numbers. Getting to ₹1 Cr might feel like 10% of the ₹10 Cr journey, but it takes 45% of the total time. Because all your effort comes BEFORE compounding picks up steam.

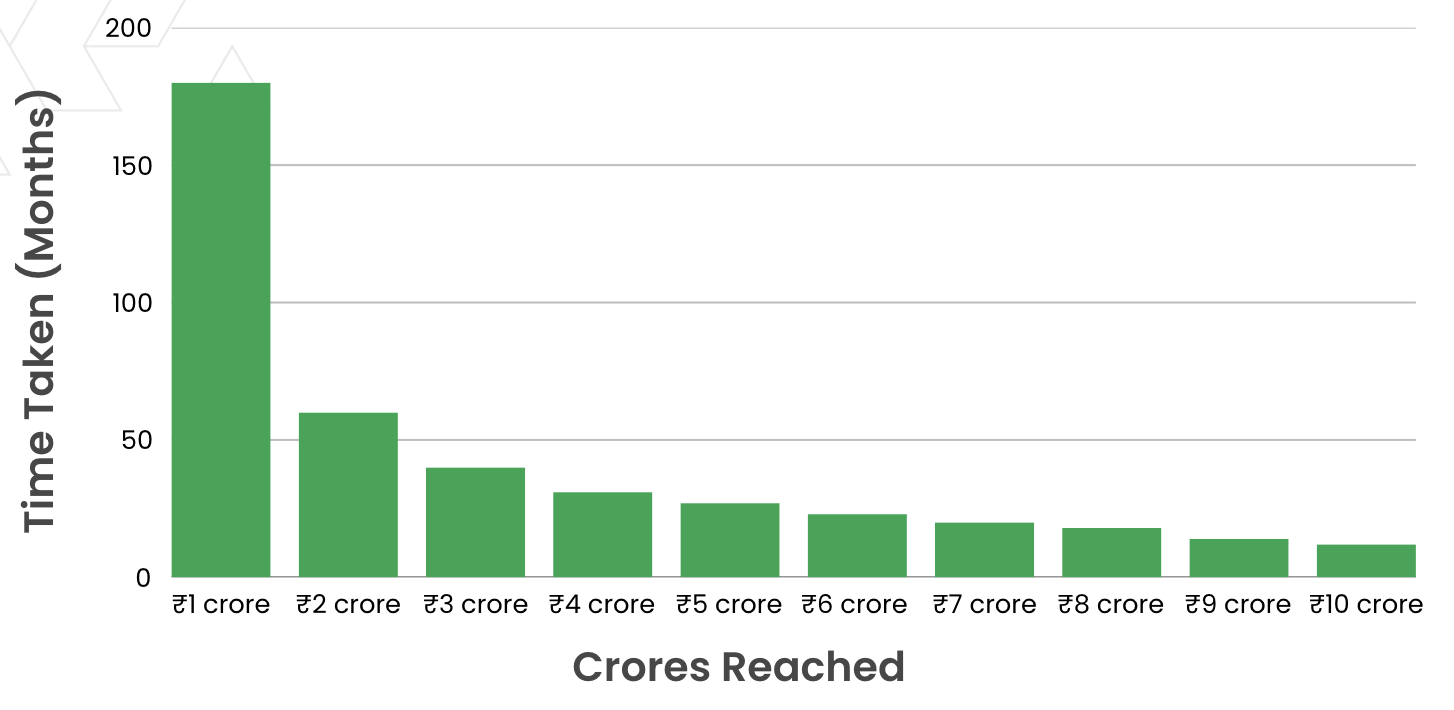

Say you invest ₹20,000 per month.

Earn 12% per annum in the long run. Time to reach ₹1 crore? About 15-16 years. (See chart)

But your second crore requires just 5 years. Third? 3.5 years. And each subsequent crore requires less time than the previous one.

Let’s take another example :

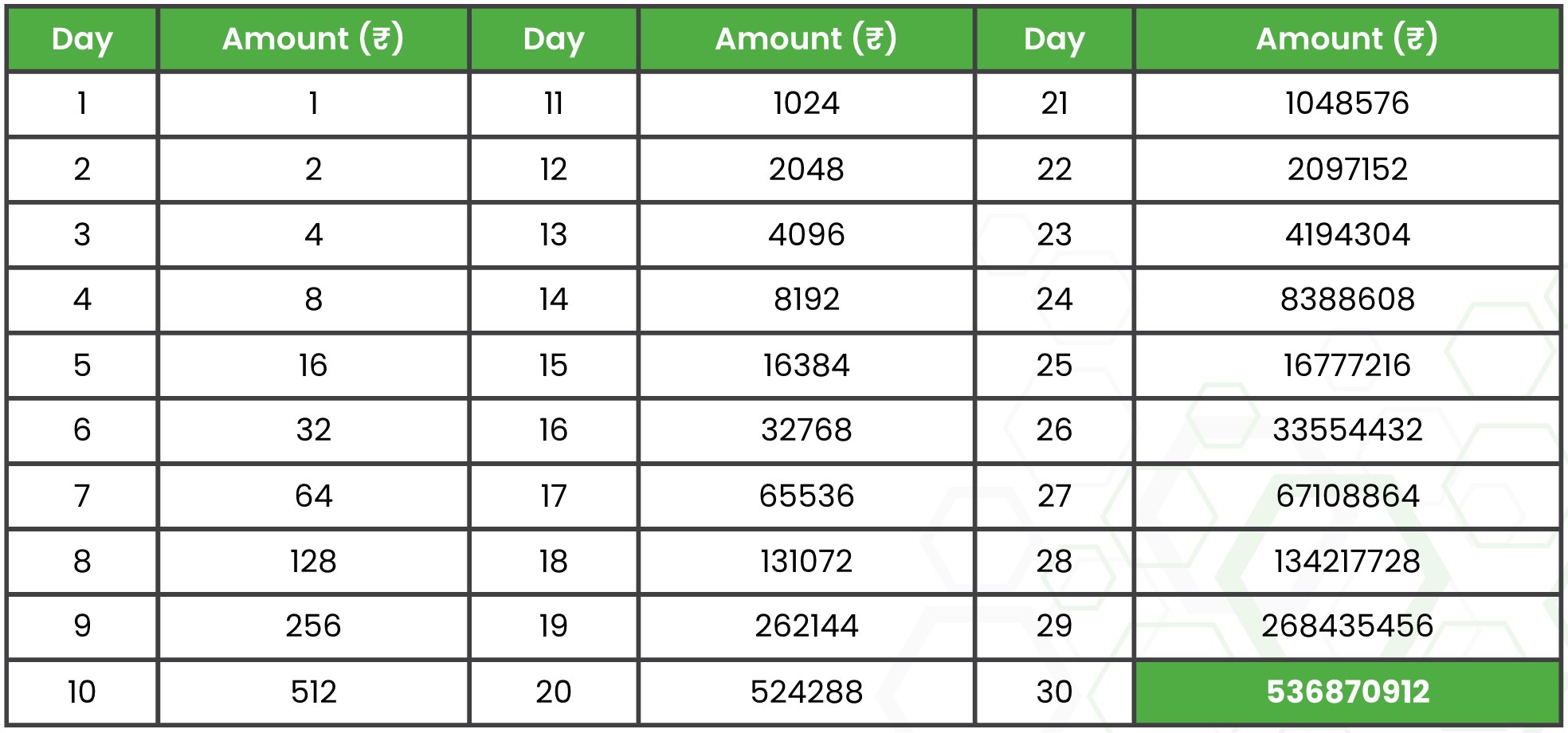

Would you take ₹10 crore today, or ₹1 that doubles every day for 30 days? Most people grab ₹10 crore. Because in the early days, ₹1, ₹2, ₹4 looks like nothing. At this point, option 1 feels like the smarter choice.

But by Day 20, the amount shoots up to ₹5.24 lakh. By Day 30? ₹53.69 crore. (See table) Yes, we know this is how most multi-level marketers pitch their schemes, but we hope you get the drift. Investing is quite similar. The first decade feels slow. The second feels like magic.

Why is the first crore the hardest? There are 3 key challenges along the way. First, you start with low income, limited savings, and rising expenses.

Second, investing is a new territory for most people. Where to invest? What to do in a crash? How to manage risk? You are learning as you go, often through mistakes. There’s no perfect roadmap, but every experience makes you better.

Then comes the emotional rollercoaster. Market dips test your patience. Big rallies tempt you to chase returns. You may pause SIPs out of caution or act on headlines. But these are natural phases every investor goes through.

Most people even try to time the market. But they often miss the costs it brings along. If you’d invested ₹5,000 every month in the Sensex over 10 years and missed just the 10 best days, your wealth drops by 34%. Miss 20 best days? Down 45%.

Wrap Up :

Start small, but stay consistent. Increase your SIPs as your income grows. Focus on what you can control: savings rate, patience, and behaviour. Compounding will surely reward discipline.

Disclaimer: The information provided in this infographic is for educational purposes only and should not be considered as financial advice. We recommend consulting a certified financial professional before making any major financial decisions. Omega Financial is not liable for any decisions made based on this material.

Source: ET Money

Investment in the equity market and securities is subject to market risk; read all the scheme-related documents carefully.