Category: Financial Blog

Financial Blog

Uncategorized

Protected: Understanding XIRR vs Absolute Return | Omega Financial

There is no excerpt because this is a protected post.

Read More

Financial Blog

Uncategorized

Protected: USD/INR Reaches 90: Key Insights for Indian Investors

There is no excerpt because this is a protected post.

Read More

Financial Blog

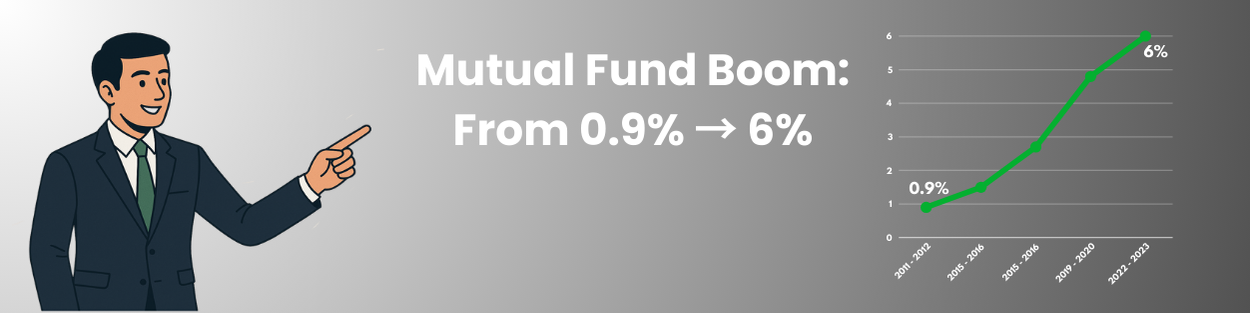

The Mutual Fund Boom: From 0.9% to 6% of Household Savings

In the last decade, India’s investment landscape has undergone a silent but powerful revolution. What was once a market dominated by traditional savings instruments like bank deposits, gold, and real estate is now seeing a decisive shift toward financial assets—particularly mutual funds. A clear reflection of this change lies in a striking statistic: the share […]

Read More

Financial Blog

Financial Scams 2025: Omega Financial Keeping India Safe

In 2025, India’s financial landscape is evolving faster than ever before. Digital banking, UPI payments, and online investing have brought unmatched convenience — but they’ve also opened the door to a new wave of sophisticated scams. The Reserve Bank of India (RBI) recently reported that bank fraud losses soared to ₹36,000 crore in the year […]

Read More

Financial Blog

Why Digital Literacy Is the New Key to Financial Freedom

- August 16, 2025

- Chhattisgarh finance

- digital banking safety

- digital literacy

- financial awareness workshops

- financial education

- financial empowerment

- financial literacy programs

- financial scams

- investor awareness

- money management India

- Omega Financial

- personal finance india

- scam prevention

- social media learning

- UPI fraud

In 2025, the way people learn about personal finance has shifted dramatically. The fusion of social media, mobile-first platforms, and interactive financial education resources has transformed financial learning from a passive, one-way flow of information into an engaging, community-driven experience. This shift is shaping a generation that is not just financially literate, but also highly […]

Read More

Financial Blog

5 Financial Lies We Tell Ourselves That Keep Us Broke

- August 5, 2025

- Common Money Myths

- Credit Card Debt Trap

- EMI vs Saving

- financial freedom India

- Financial Lies

- How to Build Wealth

- Insurance Investment Mistakes

- Money Management Tips

- Money Mistakes to Avoid

- Mutual Fund Education

- Omega Financial Blog

- Personal Finance Awareness

- Personal Finance Habits

- Saving and Investing Tips

- Start SIP Early

Most people believe they don’t earn enough to save or invest. It’s a common excuse — “Once I start earning more, then I’ll think about savings.” But the reality is different. If you earn ₹6 lakh per year (₹50,000 per month), you are already richer than 80% of India’s population. The problem is not always […]

Read More

FinCon

5 Mistakes in SIP that most people do

SIP is one of the easiest and effective ways to build long term wealth. The concept is simple, just invest regularly, check periodically and stay aligned to your goals. Despite its simplicity many investors make basic yet avoidable mistakes. Let’s surf through them and make your SIP journey benefitting. 1. Skipping SIP SIP is like […]

Read More

FinCon

Israel-Iran Blowout: Impact on India

PROLOGUE Following Israel’s attack on Iran has jeopardized the world economy proving that even a regional conflict may result in global aftershocks. The military tension between Israel and Iran provoked by retaliatory strikes has greatly impacted energy prices, financial markets and emerging economies. The growing tension between the two countries has put constraints on India […]

Read More

Financial Blog

India Becomes 4th Largest Economy, Surpassing Japan

In a landmark achievement that underscores India’s remarkable economic transformation, the nation has officially overtaken Japan to become the world’s fourth-largest economy. This historic milestone, recently confirmed by NITI Aayog CEO B.V.R. Subrahmanyam, marks a pivotal moment in India’s journey toward becoming a global economic powerhouse. The Numbers That Tell the Story According to the […]

Read More

FinCon

Building your first ₹1 crore takes more time than the next ₹9 crore combined.

The journey from ₹1 crore to ₹10 crore doesn’t get harder. It gets faster. Here’s the math and mindset shift that explains why : Let’s start with some surprising numbers. Getting to ₹1 Cr might feel like 10% of the ₹10 Cr journey, but it takes 45% of the total time. Because all your effort […]

Read More