India has conducted OPERATION SINDOOR last week to avenge the Pahalgam attack. The overnight attack was on 9 terrorist base camps of Pakistan and POK* .

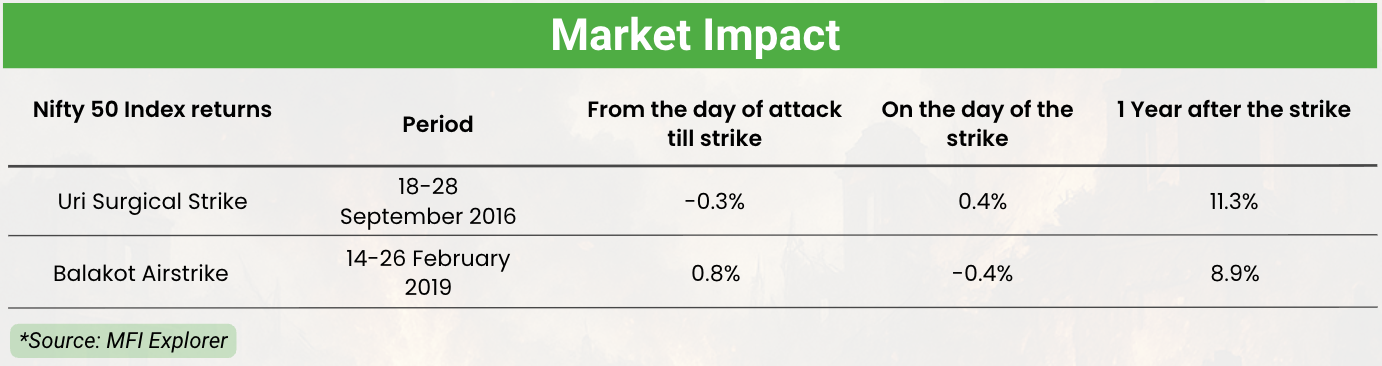

We have seen two such surgical strikes since 2016 (Uri and Balakot) and the impact on markets have been limited.

*Source: Press Release clickhere

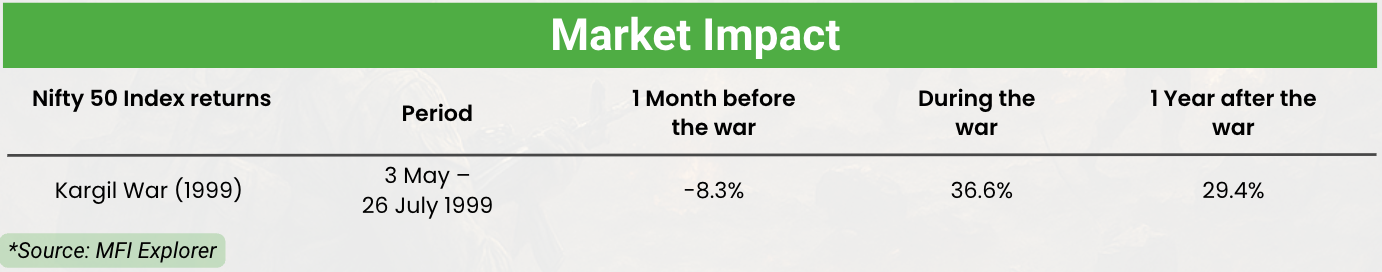

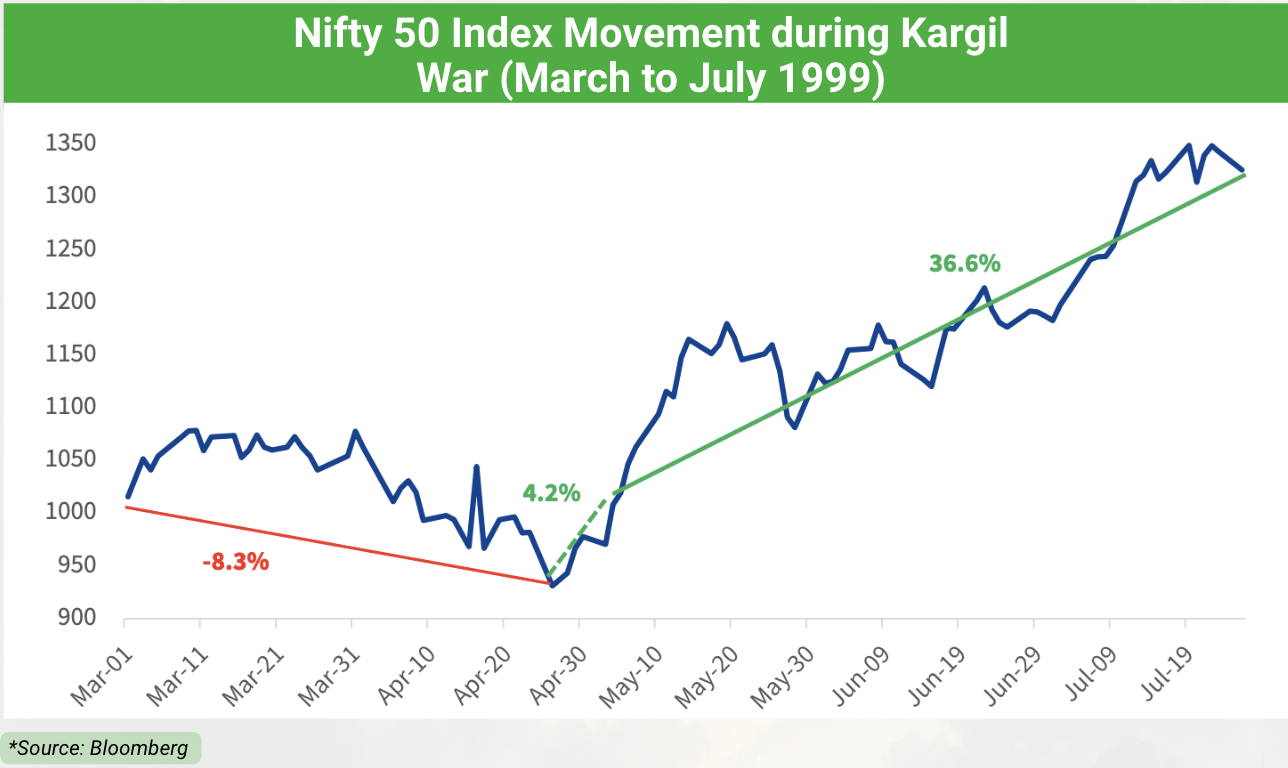

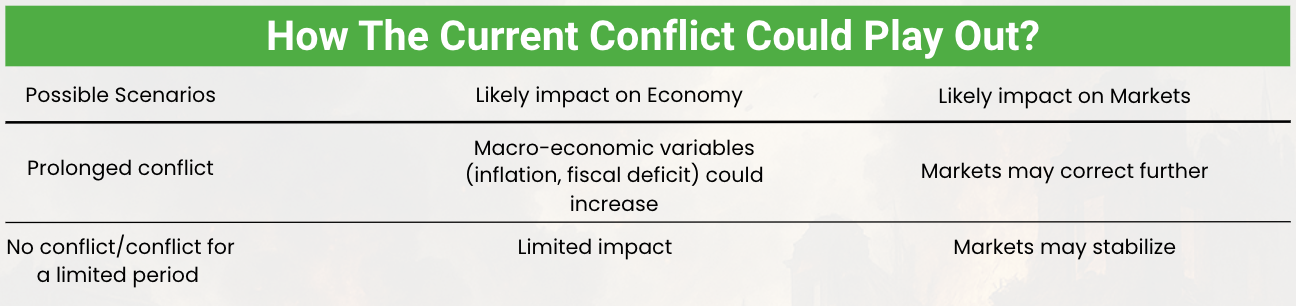

Government action suggests there is low possibility of a war. However, in case of a full-blown war, we must note that since 1950, India has seen 4 major wars. In the last major conflict (Kargil-1999), the equity markets have remained robust after an initial panic.

Short term market swings during geopolitical events are unsettling, but history shows that they rarely derail India’s long term growth story. In the long term, the macroeconomic factors and corporate earnings drive the stock market performance.

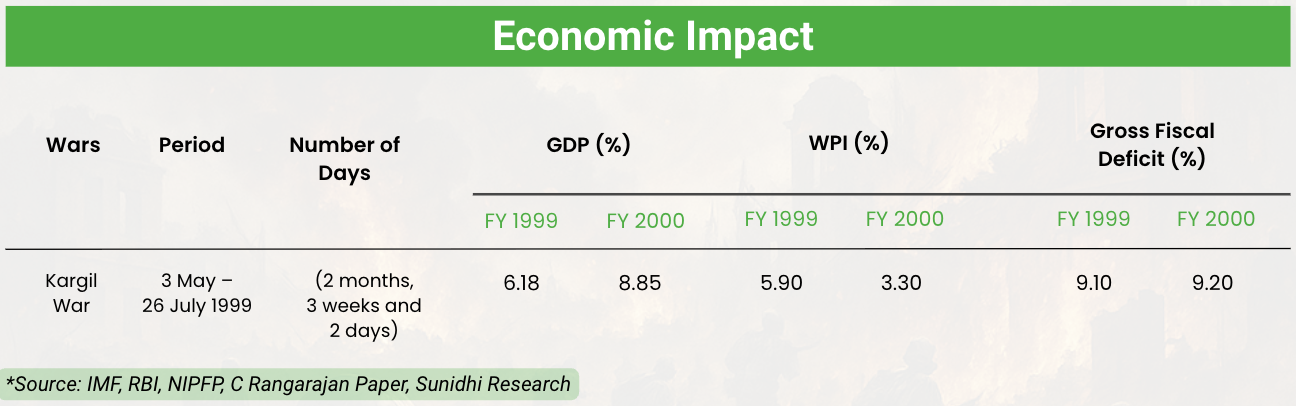

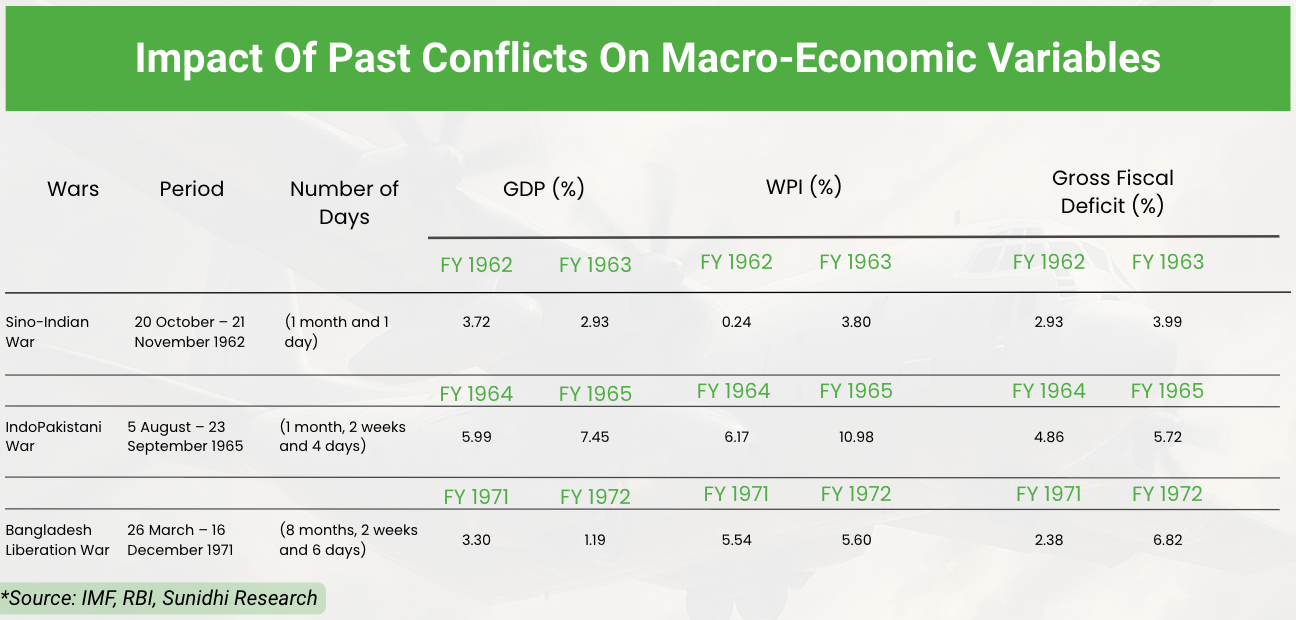

In the past conflicts, while there has been limited impact on growth, we have seen increase in inflation and fiscal deficit.

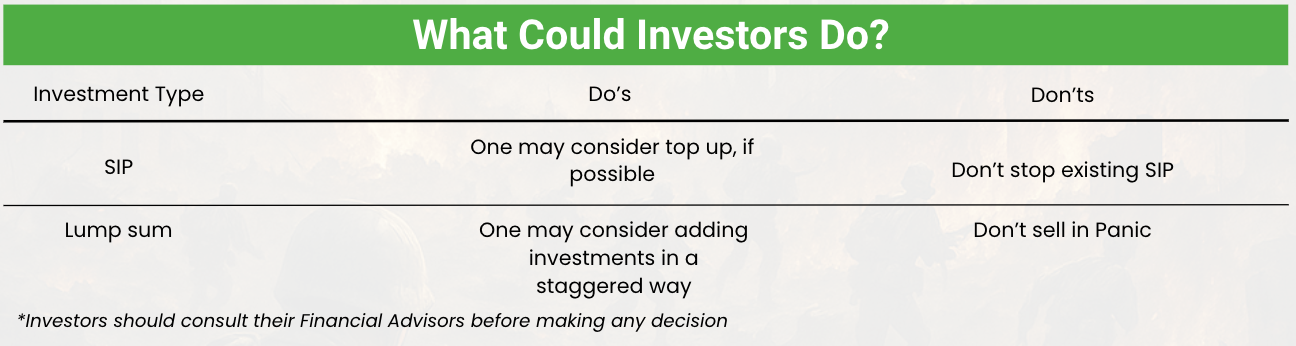

It is difficult to predict the market direction however the last major conflict have triggered temporary drawdowns before markets rebounded. Staying invested and avoiding knee-jerk decisions may be prudent for long-term wealth creation.

These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. Past performance may or may not be sustained in future | Omega Financial is not guaranteeing or promising any returns/futuristic returns.

Source: Kotak Mutual Fund

*MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.