Introduction

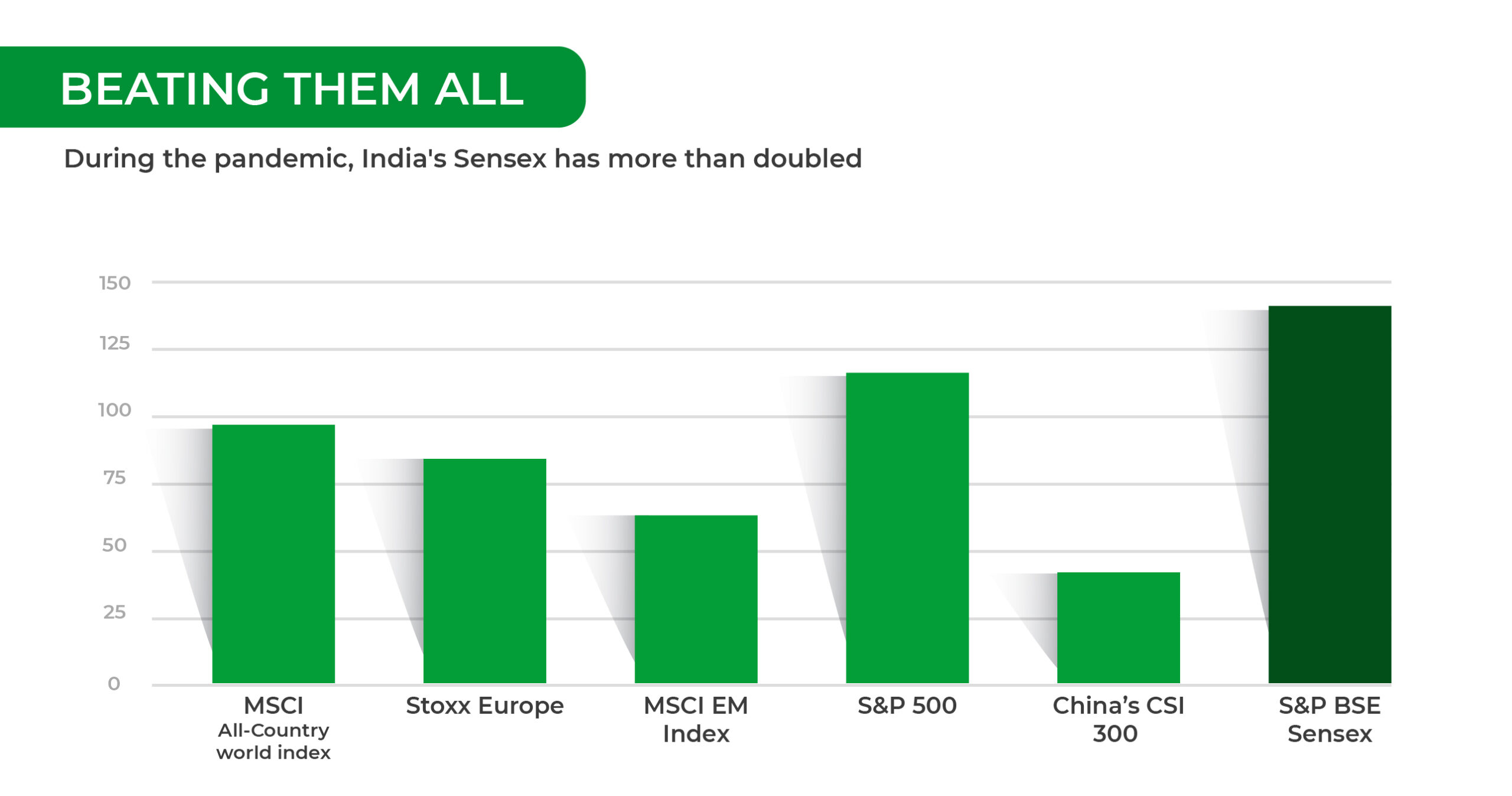

The Year 2021 has been a roller coaster ride for the Indian Markets as we’ve seen many highs and lows in the market and the economy. Both the Indices, Sensex and Nifty 50 made higher highs and private companies went crazily public. We have seen a huge amount of volatility. The number of retail individual investors participating in the Indian stock market has increased dramatically. We’ll see all about that in this Blog – SumUp 2021: The Indian Stock Market Rush.

Breakdown of the Year’s First Half (6 months)

The year started with optimism of having a Vaccine to prevent Covid-19. During the January-June period 2021, investors were hooked to Indian Stock markets due to the increasing rate of vaccination, the government’s stimulus packages, and the Reserve Bank of India’s liquidity support mechanisms.

As mentioned above, it was a period of optimism but there were lows in this period as well. COVID-19′s second wave proved catastrophic, causing havoc on the markets and in the healthcare industry. Despite recent incidents, it demonstrated the healthcare system’s lack of preparedness. Despite the fact that the markets took some time to recover from the shock, they continued to rise. Since, the Start of the year the indices had the best six-month run in the last five years.

Both the Sensex and the Nifty 50 were down around 15% in the same period in 2020 when compared to 2021. So, yes one can say that the markets performed very well. Despite localized lockdowns and the escalating COVID-19 situation in India. Equity stood up to be the best performing among the asset classes.

Other asset types, such as gold and the rupee, have dropped in value over the last six months. In the January-June period, international gold prices per ounce declined 7.44 percent, while the Indian rupee fell 1.6 percent versus the US dollar.

What caused The Indian Stock Market Rush?

The Stock market has experienced many factors that led to this surge in the first place. Few reasons are explained and listed below:

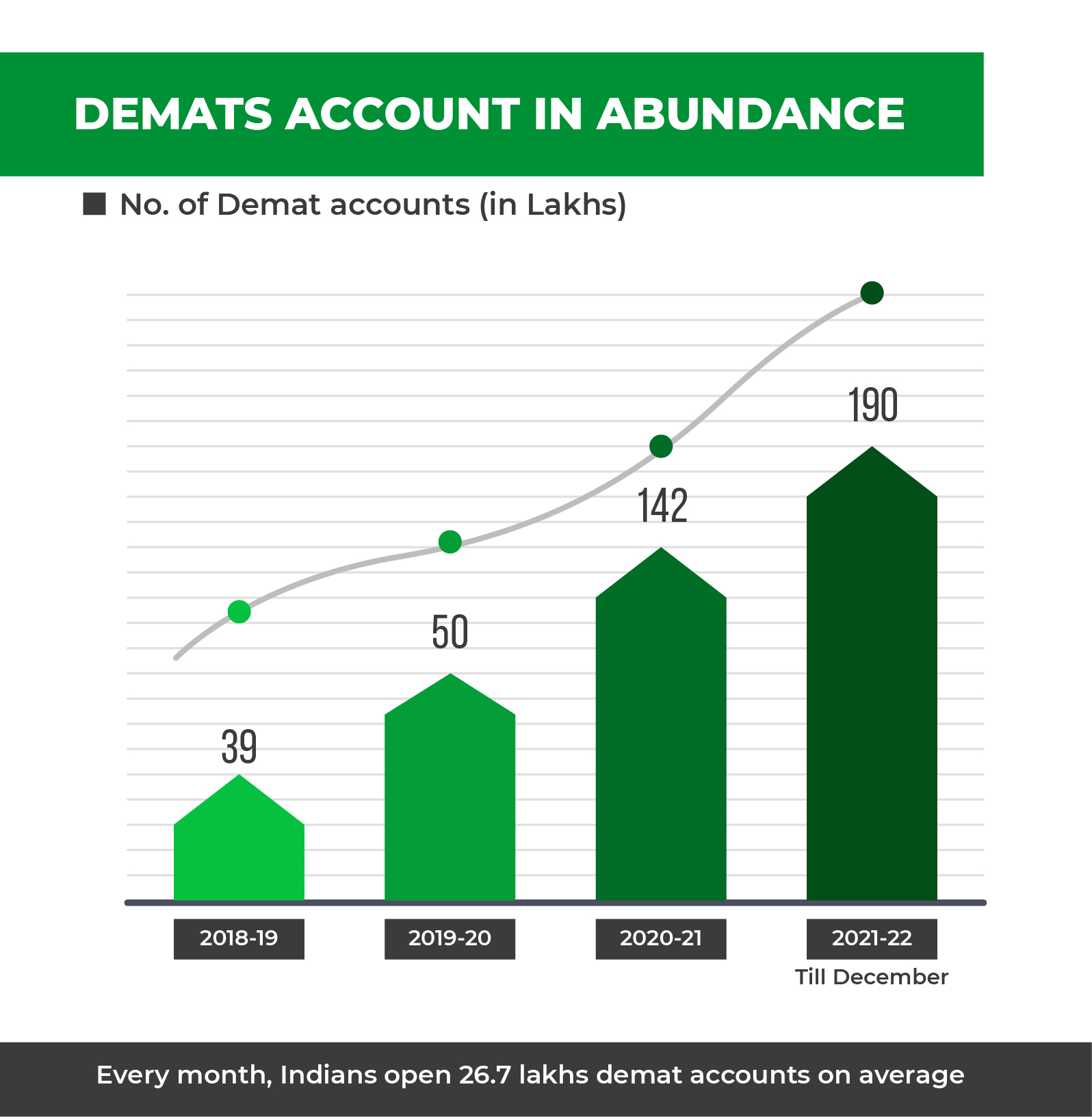

- New and Young Investors: The online Broking platforms experienced an unexpected surge in the number of daily trades taken and the CDSL (Central Depository Services (India) Limited) has reported opening of a large number of Demat accounts in the year 2021. As in most of India localized lockdowns were forcing people to stay at home, many saw this as an opportunity to make a side income or to increase their wealth.

More and more families are investing in stock markets from Vietnam to South Korea, but the rate at which India is attracting new investors is unparalleled. This year, retail investors invested 860 billion rupees in the cash market of India’s National Stock Exchange, compared to 512 billion rupees in 2020.

Whatever the reason, this increased the participation of new and young investors in the market, bringing a new supply of cash/liquidity to the market and thus making it more volatile, because such new investors can be referred to as “know-nothing” or “rookie” investors (as Warren Buffet put it). They invest primarily on emotion rather than rationality. Such irrational trades increase volatility in the markets.

- IPO Frenzy: This is a record year for IPOs (Initial Public Offering). Many of India’s largest technology start-ups have already gone public, signaling the start of a new era for the whole ecosystem, according to some investors.

In the second half of 2021, technology-enabled startups like Zomato (Rs. 9,375 crore), Nykaa (Rs. 5,351.91 crore), Paytm (Rs. 18,500 crore), and Policy Bazaar (Rs 5,625 crore) went public, raising more money than other IPOs. Zomato was the first in the line to come up with an IPO and the rest followed. Such great Activities in the Primary markets caused the Indian Stock Market Rush in 2021.

According to a research published by Goldman Sachs on Sept. 19, Indian start-ups have raised $10 billion in IPOs this year, more than in the previous three years. The investment bank said in a recent study that the pipeline for future public offerings is projected to remain strong over the next two years. Goldman Sachs estimates, up to 150 private companies could list on the public market in the following 36 months, adding up to $400 billion in market value.

Such well-known companies lured new investors to invest in them and as many of them gave pretty good returns to the investors. Few IPOs performed badly as well. For Example, Paytm which was the largest IPO ever to hit Indian Market, gave a negative return of 39% on listing.

- Other Factors: Many other factors such as good inflow of money from Foreign Institutional Investors and market-friendly reforms by Indian policymakers implemented well, which resulted in more liquidity from domestic and international investors, pushing the markets upward.

Conclusion

This brings us to the end of our blog for today. We must admit that 2021 was a year of ups and downs for most of us, as many of you reading this blog may have been affected by the Covid-19 pandemic on an emotional, physical, and financial level.

Such events make us think about our life a little bit differently. We are Omega Financial, and our goal is to help you achieve financial stability and security. Our Financial products such as Mutual Funds, Retirement savings scheme, Life Insurance, Health Insurance, Income tax services and Portfolio Management services, cover all your financial needs at one place. Visit our website and read about our services or follow us on our social media platforms to stay updated on what’s going on in the financial world.

This blog summarizes how the Indian Stock Markets performed in 2021 and what are the reasons behind it. All-in-all the markets did well, but the underlying economic factors such as Retail and Wholesale Inflation, Unemployment, loan interest rates do not support such costly valuations of the stock market. Various Investment banks and analysts are warning the investors to stay cautious. Stay tuned for the next blog.